Respect Senior Care Rider: 9152007550 (Missed call)

Sales: 1800-209-0144| Service: 1800-209-5858

Service Chat: +91 75072 45858

Service Chat: +91 75072 45858

Thank you for visiting our website.

For any assistance please call on 1800-209-0144

IRDAI (The Insurance Regulatory and Development Authority of India) on September 20, 2018, announced new rules that will be applicable while purchasing and renewingthe two-wheeler & car insurance policies.

The changes in the policy were made because it was noticed that the existing CPA (Compulsory Personal Accident) cover was very low and insufficient.

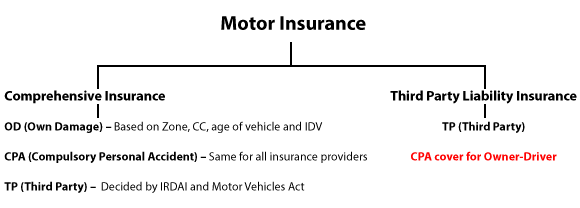

The changes have been made to the component marked in Red. In India, it is mandatory for all the vehicle owners to buy a third party liability insurance. This third party liability insurance has two components:

Following are the changes in the third party liability insurance:

These changes have been rolled out for all the motor insurance policies (new purchase or renewal process). The new regulations are still settling in and the insurance companies are complying with these changes to provide the best motor insurance plans to their esteemed customers.

Please visit our website or reach out to us via our Toll-Free number if you have any queries regarding the changes made in the Personal Accident Cover.

We will keep updating this write-up to include all the latest changes made in the motor insurance policies. Requesting you to keep watching this space for more details.

Tags : Bajaj Allianz Two Wheeler Insurance Components of helmet Dangers of riding without helmet

Disclaimer

I hereby authorize Bajaj Allianz General Insurance Co. Ltd. to call me on the contact number made available by me on the website with a specific request to call back at a convenient time. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) under either Fully or Partially Blocked category, any call made or SMS sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business. Furthermore, I understand that these calls will be recorded & monitored for quality & training purposes, and may be made available to me if required.

Please enter valid quote reference ID